In 1997, to overcome these difficulties, the International Organization for Standardization (ISO) published ISO 13616:1997. Routing errors caused delayed payments and incurred extra costs to the sending and receiving banks and often to intermediate routing banks. It also does not contain check digits, so errors of transcription were not detectable and it was not possible for a sending bank to validate the routing information prior to submitting the payment. Routing information as specified by ISO 9362 (also known as Business Identifier Codes (BIC), SWIFT ID or SWIFT code, and SWIFT-BIC) does not require a specific format for the transaction so the identification of accounts and transaction types is left to agreements of the transaction partners. This often led to necessary routing information being missing from payments. bank, branch, routing codes, and account number) were confusing for some users. The check digits enable a check of the bank account number to confirm its integrity before submitting a transaction.īefore IBAN, differing national standards for bank account identification (i.e.

#Un iban validator code#

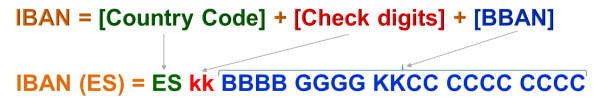

The IBAN consists of up to 34 alphanumeric characters comprising a country code two check digits and a number that includes the domestic bank account number, branch identifier, and potential routing information. As of May 2020, 77 countries were using the IBAN numbering system. Initially developed to facilitate payments within the European Union, it has been implemented by most European countries and numerous countries in other parts of the world, mainly in the Middle East and the Caribbean.

The current standard is ISO 13616:2020, which indicates SWIFT as the formal registrar. It was originally adopted by the European Committee for Banking Standards (ECBS) and later as an international standard under ISO 13616:1997.

An IBAN uniquely identifies the account of a customer at a financial institution. The International Bank Account Number ( IBAN) is an internationally agreed system of identifying bank accounts across national borders to facilitate the communication and processing of cross border transactions with a reduced risk of transcription errors. A typical British bank statement header (from a fictitious bank), showing the location of the account's IBAN

0 kommentar(er)

0 kommentar(er)